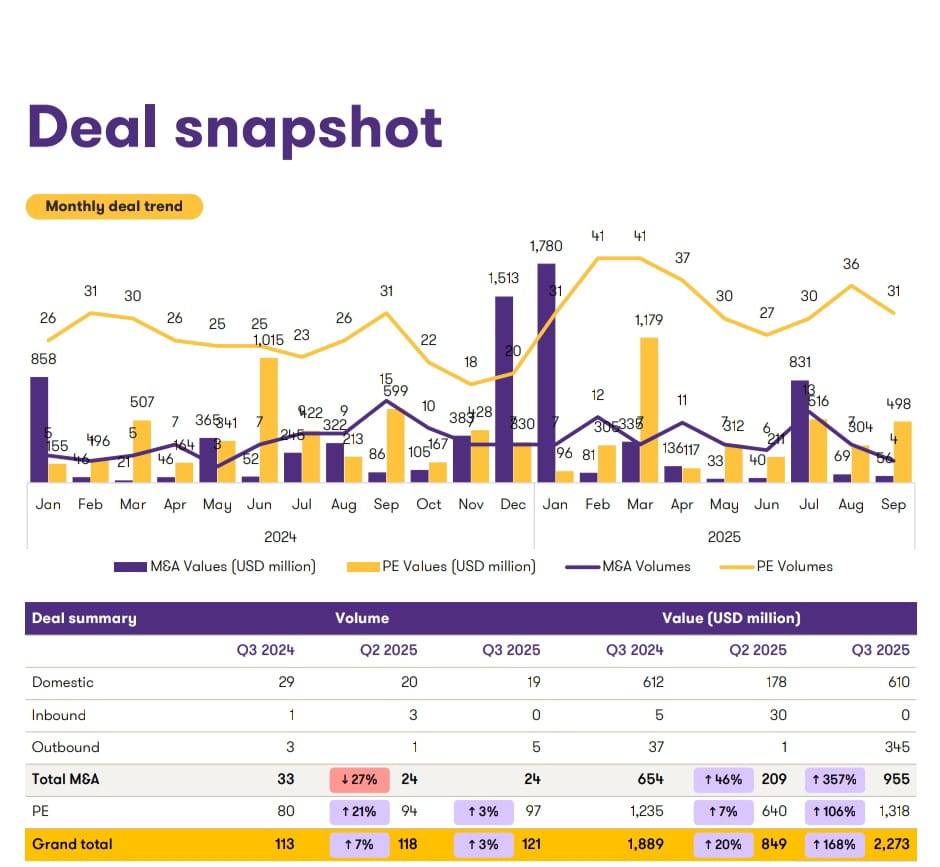

According to Grant Thornton Bharat’s Consumer and Retail Dealtracker, the sector witnessed robust deal momentum in Q3 2025, recording a total of 132 transactions valued at USD 3.4 billion, up 6% in volumes and 9% in value compared to Q3 2024, including public market activity. Excluding public market deals, M&A and PE deal activity accounted for 121 deals worth USD 2.3 billion, marking a 168% increase in value quarter on quarter. The surge was driven by five high-value deals above USD 100 million and 26 deals above USD 10 million, together contributing USD 2 billion or 89% of total deal value, signalling strong investor confidence in scale, brand strength, and growth-oriented consumer businesses. Textiles, apparel, and accessories remained a top focus, attracting significant M&A and private equity inflows, while food processing and e-commerce segments benefited from festive season momentum, with online sales surging and quick commerce capturing growing consumer attention. The rise in average deal size to USD 18.8 million from USD 7.2 million in Q2 highlights a shift toward value-driven transactions, underpinned by larger, capital-intensive deals and selective strategic investments across the sector.

Naveen Malpani, Partner and Consumer Industry Leader, Grant Thornton Bharat, commented on the

deal activity, “Q3 marked a decisive rebound for India’s consumer and retail sector, with deal volumes rising to 132 and values crossing USD 3.4 billion, nearly four times higher values than the previous quarter. The recovery was led by renewed investor focus on textiles, apparel & accessories, and sustained activity in food processing and e-commerce. These categories reflect the intersection of traditional strengths and digital disruption shaping India’s consumption story. The quarter also witnessed a revival of outbound M&A, with Indian consumer players pursuing cross-border acquisitions to expand product portfolios and strengthen global footprints.”

Mergers and Acquisitions (M&A) landscape: M&A activity in Q3 2025 remained robust, recording 24 deals

valued at USD 955 million, marking a 357% increase in values from USD 209 million in Q2, while volumes

held steady. The surge was driven by larger transactions in food processing and textiles and apparel. Domestic deals dominated, accounting for 79% of volumes and 64% of value, while outbound activity picked up with five cross-border deals. Strategic acquisitions led the quarter, particularly in staples, apparel, and retail tech, with Reliance Group topping the list with three deals, followed by Tilaknagar Industries, D C Kothari Group, and Le Lavoir acquiring stakes in two companies each.

Private Equity (PE) landscape: Private equity and venture capital activity in Q3 2025 remained strong,

recording 97 deals worth USD 1.3 billion, reflecting a 3% increase in volumes and a 106% jump in values

quarter on quarter. The surge was led by textiles and apparel, e-commerce, and consumer services, driven by festive demand, brand premiumisation, and digital adoption. Larger mid-market rounds replaced Q2’s small- ticket focus, with Agilitas Sports, P-TAL, Kimirica, and Zepto each completing two funding rounds, highlighting improving investor confidence and stabilising valuation expectations.

Initial Public Offering (IPO) & Qualified Institution Placements (QIP) Landscape: Public market activity

in Q3 2025 saw a strong revival, with six IPOs and five QIPs raising over USD 1.1 billion, reflecting a sharp

5.5x increase in volumes and a jump in values from USD 36 million in Q2 2025. Urban Company and Bluestone Jewellery together accounted for 70% of IPO proceeds, while Tilaknagar Industries and Lenskart contributed 91% of total QIP values. The quarter highlighted renewed investor confidence and issuers’ intent to capitalise on favourable market conditions ahead of the festive season.

Sector Trends:

- Food Processing, FMCG and Textiles lead M&A: These sectors drove deal activity, accounting for

67% of volumes and nearly 94% of values. Large-ticket transactions such as Tilaknagar’s acquisition

of Pernod Ricard’s Imperial Blue (USD 488 million) and Titan’s acquisition of Damas Jewellery (USD

283 million) anchored the rebound. - Big-ticket M&A returns after muted quarters: Q3 saw the return of larger, scale-driven deals in

staples, liquor, and jewellery. Two high-value deals (> USD 100 million) and four deals above USD 10

million together valued at USD 891 million contributed 93% of total deal values, compared to just five

deals above USD 10 million totaling USD 128 million in Q2. - Strategic consolidation in apparel and accessories: Titan, Lenskart, and smaller acquisitions in

apparel and accessories emphasised distribution expansion and premiumisation. Carry bag and

jewellery brands were prominent in the deal flow. - Consumer durables and home furnishing: Asian Paints’ acquisition of White Teak and Reliance

Retail’s Kelvinator buyout reflected portfolio diversification into lifestyle categories. - Cross-border revival: Outbound transactions such as Titan’s UAE jewellery acquisition and

Lenskart’s buy in Spain marked the return of Indian consumer players to international markets after

subdued cross-border activity in earlier quarters. - E-commerce and tech-enabled consumer devices: Festive-driven PE investments targeted vertical-

first marketplaces, community commerce, quick commerce models, robotics, and AI- or IoT-led consumer devices. Notable deals included Jumbotail, Zepto, CityMall, FirstClub, Miko, and Indkal Technologies. - Lifestyle and personal care: Scalable, tech-enabled services and premium consumer brands saw

sustained interest, with key transactions in wellness, childcare, and beauty sectors, reflecting a focus on differentiated and resilient business models.